O Canada, can we have Alberta?

Jon D. Markman, editor, The Daily Advantage

Canada's oil sands could rival Saudi Arabia's vast reserves as a source for oil. And even if we don't annex, investors can buy a piece of the action. Consider these 4 companies.

Last month, Canada threw out its namby-pamby liberal government and ushered in a new era of conservative rule. Thank goodness for small favors. Now when we run out of crude oil and natural gas down here in the United States, we won’t have to invade our neighbors to the north to make sure the lights stay on. We can just arrange a friendly annexation.

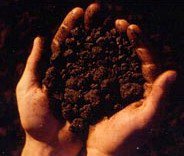

O Canada! We love your beer, your funny accents, your flag with the botanical theme. Now be a dear and just let us have Alberta. Hey, it’s just one province. You have nine more, plus three territories. You can keep the ones named after a dog (Labrador) and an SUV (Yukon) and all the rest. We just want the one with those nasty, dirty tar sands. We’ll practically be doing you a favor. Why the tar sands? It’s not just that it sounds like "Tarzan" after a couple of Molsons. (Funny, eh?) It’s just that, well, we think all that sticky, gooey mess up in the Athabasca region is North America’s answer to Saudi Arabia, as I explained back in mid-2004. And most of North America is already chez nous anyway, as they say in Quebec. So hand it over. Or else.

Why the tar sands? It’s not just that it sounds like "Tarzan" after a couple of Molsons. (Funny, eh?) It’s just that, well, we think all that sticky, gooey mess up in the Athabasca region is North America’s answer to Saudi Arabia, as I explained back in mid-2004. And most of North America is already chez nous anyway, as they say in Quebec. So hand it over. Or else.

Stable, with a capital C

You may have heard that President Bush, in his State of the Union address last week, mentioned that the U.S. must slash its dependence on oil from “unstable nations” in favor of cute little science projects like ethanol, nuclear plants and solar panels. But surely you knew that was sort of an inside joke. Most of those projects are a decade away from viability.

What he really meant was that we’d rather strip-mine our BTUs from the perfectly stable Alberta tar pits, which are so close to home that they might as well be ours.

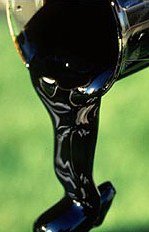

Federal energy officials figure U.S. oil imports from Canada will almost double over the next 20 years, to 2.7 million barrels a day from 1.6 million. That would go a long way toward cutting our imports of Mideast oil to 3 million barrels a day from 6 million. But it’s only a start. It’s a little hard to believe, but the tar sands in Alberta -- also sometimes called “bitumen,” which rhymes with vitamin -- hold 175 billion barrels of recoverable oil. That rivals Saudi Arabia’s reserves, and would help get us well in a hurry. Might as well call it Vitamin T.

It’s a little hard to believe, but the tar sands in Alberta -- also sometimes called “bitumen,” which rhymes with vitamin -- hold 175 billion barrels of recoverable oil. That rivals Saudi Arabia’s reserves, and would help get us well in a hurry. Might as well call it Vitamin T.

Scientists believe another 315 billion barrels will be recoverable when new technology comes online, which would expand Canada’s conventional oil reserves by a factor of 70x. If that works out as expected, Canada could ultimately produce as much as 25 million barrels of oil per day and leapfrog ahead of Iran, Mexico, China and Norway to become one of the world’s top three energy producers.

However, it isn’t expected to come within 20% of that level even within the next 20 years due to the difficulty of production.

Worth taking?

It’s little wonder that Alberta opened up an office of its own in Washington recently, headed by former energy chief Murray Smith. All the easier to negotiate a peaceful surrender.

To be perfectly frank, you’d think that Canada would be happy to be rid of it. Tar sands may represent up to two-thirds of the world’s entire stockpile of oil, with most of it in Alberta and northern Venezuela. But the fact that every Canadian does not live like a sheikh is testament to the plain reality that it’s really hard to turn the stuff into useful energy.

First you need to strip-mine it from deep in frozen ground with enormous bulldozers and cart it away with gigantic dump trucks. And then you need to blast it with steam to separate the oil from the sand and clay, an operation that demands a vast amount of water -- which is not particularly plentiful -- and pricey natural gas. It also leaves behind a big, mucky mess, much to the chagrin of anyone who cares about the environment. It also emits a lot of greenhouse gases and destroys boreal forests and bogs. Then, when you’re done, the oil is very heavy and “sour” -- unlike the sweet, light crude oil of West Texas and Saudi Arabia -- so it is hard to transport by pipeline, and even then can really only be used for diesel. And the plants are subject to a lot of hardships, such as the lack of skilled labor, the breakdown of the heavy machinery and a worldwide shortage of the sort of super-sized tires used by the mining trucks.SuperModels newsletter

Then, when you’re done, the oil is very heavy and “sour” -- unlike the sweet, light crude oil of West Texas and Saudi Arabia -- so it is hard to transport by pipeline, and even then can really only be used for diesel. And the plants are subject to a lot of hardships, such as the lack of skilled labor, the breakdown of the heavy machinery and a worldwide shortage of the sort of super-sized tires used by the mining trucks.SuperModels newsletter

Victory, without firing a shot

If our play to put the Great White North under the Red White and Blue doesn’t work out -- and maybe it shouldn’t, come to think of it -- we could always just invest in the top tar-sands companies. The top Canadian oil sands pure plays rose more than 200% on average in 2005, and there’s probably still a long ways to go. Companies with a lot of exposure to oil sands will generate tremendous free cash flow for at least 20 years, judging from the current estimates of reserves and rates of production, even if they have to invest another $10 billion or more to get the job done. The projects break even when the world crude-oil benchmark is at $20 per barrel, or one-third the current price.

One of the top names up there is Suncor Energy (SU, news, msgs). The company did $8 billion in sales and earned $782 million over the past 12 months, which was good for a $35 billion stock-market capitalization. But a lot of investments the company has made in tar sands are just coming on line, so the turnaround in earnings power has been fantastic. It earned $1.75 a share in 2004 and $1.98 in 2005, but it expected to earn as much as $4.85 in 2006 and $5.40 in 2007. Put a price-to-earnings multiple of 20 on the latter number, and you could be looking at a $100 stock in 18 months, up from $78 today.

Philip R. Skolnick, an excellent analyst at Genuity Capital Markets, likes Canadian large-caps Nexen (NXY, news, msgs), Encana (ECA, news, msgs) and Canadian Natural Resources (CNQ, news, msgs) even more. He figures that they have 27% to 60% of their future values locked up in oil sands. I’ll skip over his earnings estimates for each, and just note that they imply price targets of $78, $57 and $74, which are 20% to 40% above current levels. So if turns out we can’t take 'em, you might as well buy 'em (or pieces of 'em, anyway). This is going to be a long, long secular story: something like investing in Saudi Arabia in the 1940s. But I really do hope the State Department works out a friendly merger with our neighbors on the Athabasca plains one day, if for no other reason than it will give us a chance to shout, “Tar nation!”

So if turns out we can’t take 'em, you might as well buy 'em (or pieces of 'em, anyway). This is going to be a long, long secular story: something like investing in Saudi Arabia in the 1940s. But I really do hope the State Department works out a friendly merger with our neighbors on the Athabasca plains one day, if for no other reason than it will give us a chance to shout, “Tar nation!”

Fine Print

The nice thing about ribbing our neighbors to the north is that they have a great sense of humor; I'm kidding about the annexation, but not about the opportunity and the stocks. … In the United States, innovation is primarily focused these days around creating a better Internet search engine. In Canada, the smart kids are trying to figure out how to suck bitumen out of the ground faster.

Check out the technology of OPTI Canada here. The company trades on the Toronto stock exchange. … To learn more about the oil sands of Athabasca, read here. …The Western Oil Sands site has some nice pictures of strip mines and extraction equipment. …You can learn all about the mighty and historic Syncrude project at the Nexen site. …Suncor explains itself here. …Encana also is a major play in coal-bed methane, explained here.

source

Saturday, February 25, 2006

alberta's oil

Posted by audacious at 25.2.06

Subscribe to:

Post Comments

(Atom)

1 comments:

lol, i figured you would enjoy that.

Post a Comment